Basic salary

For further details regarding the monthly salary payment schedule, please refer to:

UMPortal → PTj Info → Jabatan Sumber Manusia (Human Resource Department) → Penggajian (Payroll) | HERE

Salary payment of a staff under the following conditions will be withhold:

Resignation;

Demise;

Having Attendance/Disciplinary problems (salary being monitored);

Completion of the period of contract (current); and

Retirement

This is to allow the University ample time to check/make preparation on the following:

The staff is free from debt with the Library/University;

The staff has settled taxes with the Inland Revenue Board of Malaysia; and

The staff has attended work in accordance with the regulations prescribed.

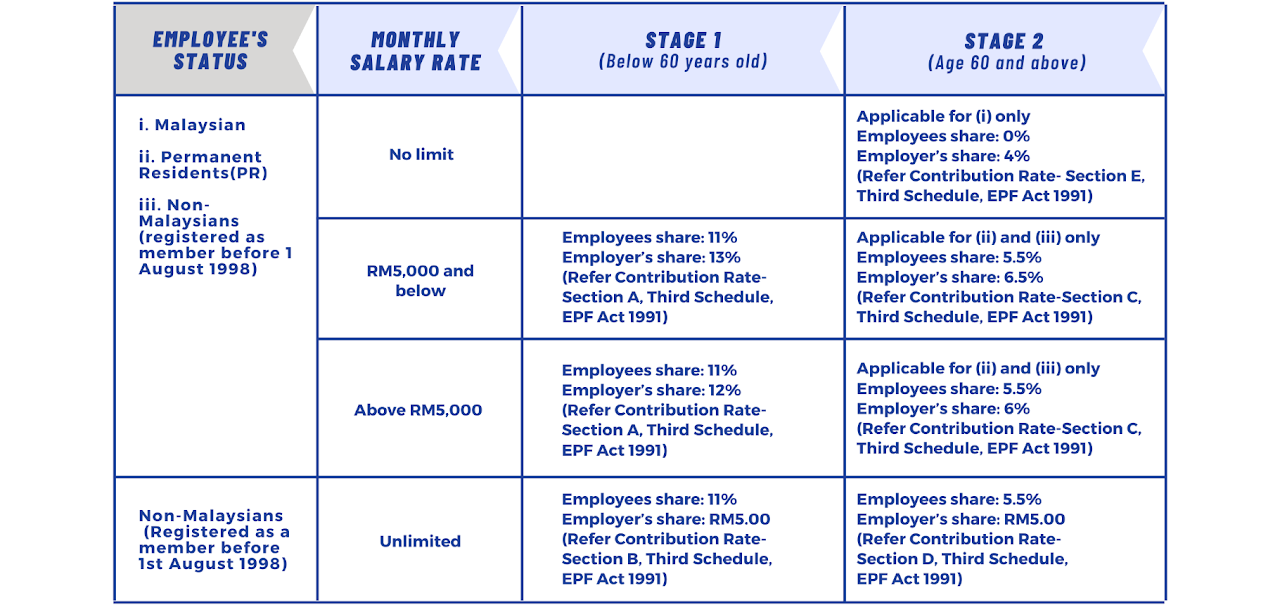

1.The EPF contribution rate for employers and employees refers to the EPF Act 1991 and is subject to current regulations.

2.The latest contribution rates for employer and employees effective from July 2022 salary/wages are as follows:

For further information, please refer to:

https://www.kwsp.gov.my/ms/

https://www.kwsp.gov.my/en/

Staff are responsible for submitting the tax form by reporting the annual income filled in the Income Tax Return Form (BNCP) either manually or through the e-Filing application (Link: https://mytax.hasil.gov.my/).

For further information, please refer to:

https://www.hasil.gov.my/individu/pengenalan-cukai-pendapatan-individu/

https://www.hasil.gov.my/en/individual/introduction-individual-income-tax/

SOCSO monthly contribution for each eligible staff is according to the rate set under the Employee Social Security Act, 1969. This contribution is divided into two (2) types:

a) Contributions of the First Category:

For employees who are less than 60 years of age, contributions payable by employers and employees are for the Employment Injury Scheme and the Invalidity Scheme.

The rate of contribution under this category comprises 1.75% of employer’s share and 0.5% of employee’s monthly wages according to the contribution schedule.

Note: All employees who have not reached the age of 60, must contribute under the First Category except for those who have attained 55 years of age and have no prior contributions before they reach 55 due to non-eligibility under the Employees’ Social Security Act, 1969.

b) Contributions of the Second Category:

The rate of contribution under this category is 1.25% of employees’ monthly wages, payable by the employer, based on the contribution schedule. All employees who have reached the age of 60 must be covered under this category for the Employment Injury Scheme only.

Note : For eligible new employees who are 55 years of age, they must be covered under the Second Category.

For further information, please refer to:

https://www.perkeso.gov.my/

https://www.perkeso.gov.my/en/

Last Update: 26/07/2023